Mint, the first online budgeting app, is shutting down.

I started using mint in Dec 2007. I was head over heels in love with all new technologies back then, and mint represented the promise of increasingly powerful applications, accessible from anywhere.

I put a lot of time and effort into getting my data into Mint, and into categorizing all the transactions to get better visibility… and honestly, I never felt like I got much insight out. The data connections were so unreliable that I lost chunks of data, and couldn’t really tell if I had overlapping data from connections breaking and reconnecting. Then came the never ending stream of useless ads and offers, so I just gave up somewhere around 2014.

I coasted without any type of financial tool until early 2022. I had recently had my first kid, and my families finances got more complicated, so I wanted to take another stab at better tracking and budgeting. The options I came across were Monarch Money, Copilot, and YNAB… there were a bunch of others but they didn’t really have modern interfaces and clean mobile apps.

I tried them all, and Monarch came away as the clear winner. YNAB and Copilot didn’t have enough flexibility, and had too much of their own perspective on how finances should be done, and I didn’t want to do things their way. After my mint.com experience, I only wanted paid software, where I was the customer and not the end product because my data was being sold.

Monarch ultimately won because:

- The connects to financial institutions have been MUCH more reliable, no issues since I joined in May 2022.

- The user interface is very intuitive, and much much less cluttered than Mint.

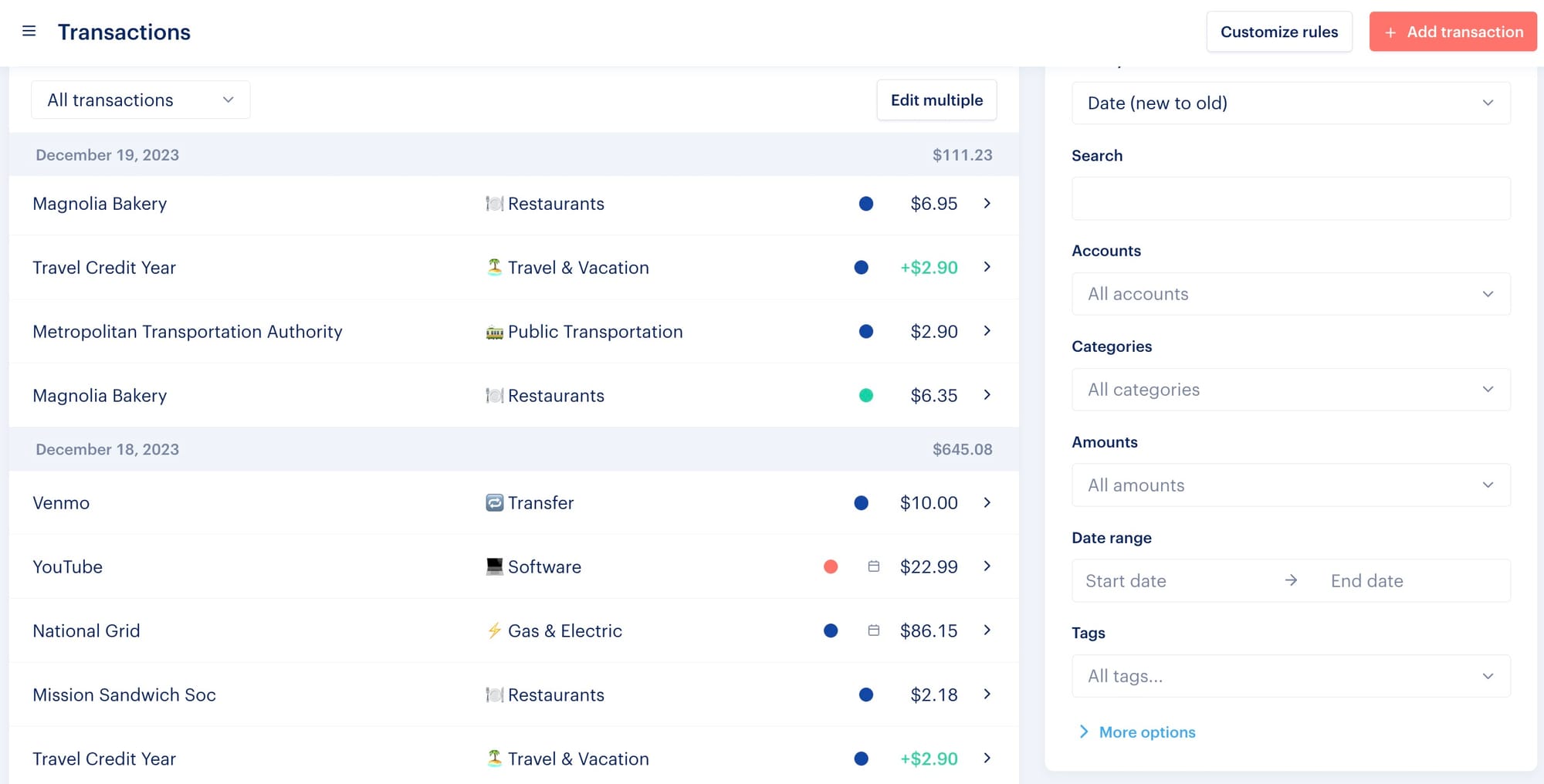

- The filters on the transaction page always help me narrow in on any areas of my finances that I’m trying to better categorize.

- No advertisements.

- Cash flow view really helped me compare segments, and income vs expenses over time to understand where things were going and what the patterns were.

Here’s a shot of some of my transactions and the nice filter options on the right hand side:

So I can say I’m happy, and I’m going to stick with Monarch for the foreseeable future, but it’s not perfect software…. Yet.

Issues and improvements:

- Monarch has attempted to integrate a data provider to get easier to read names of businesses. Sometimes the transaction on your credit card bill is a name you don’t recognize. The issue is that this has re-named some of my transactions to names that are completely unrecognizable, and I had to fix them by hand. I’ve written into support 2-3 times about this issue, and was almost angry enough to leave the service…. But they seemed to have improved that data source.

- I’d like the categorization of transactions to be completely driven by keyboard shortcuts, I don’t want to have to use the mouse to click into a transaction, then to click over to tags or categories. Thing Superhuman for finances.

- I shop too much at Amazon, and it’s a black hole in Monarch. Grocery expenses are mixed with things I’m buying for my daughter, and things I’m buying for my homies. It’s really hard to tell which expense matches with which product because Amazons buying history is terrible and it lumps together somewhat arbitrarily so the amounts never align with the products.